Member Presentations

2/2/2018: Dawn Kane - Social Butterfly Marketing

/Dawn Kane gave a fantastic presentation on the importance of Instagram for your business. For more information CLICK HERE

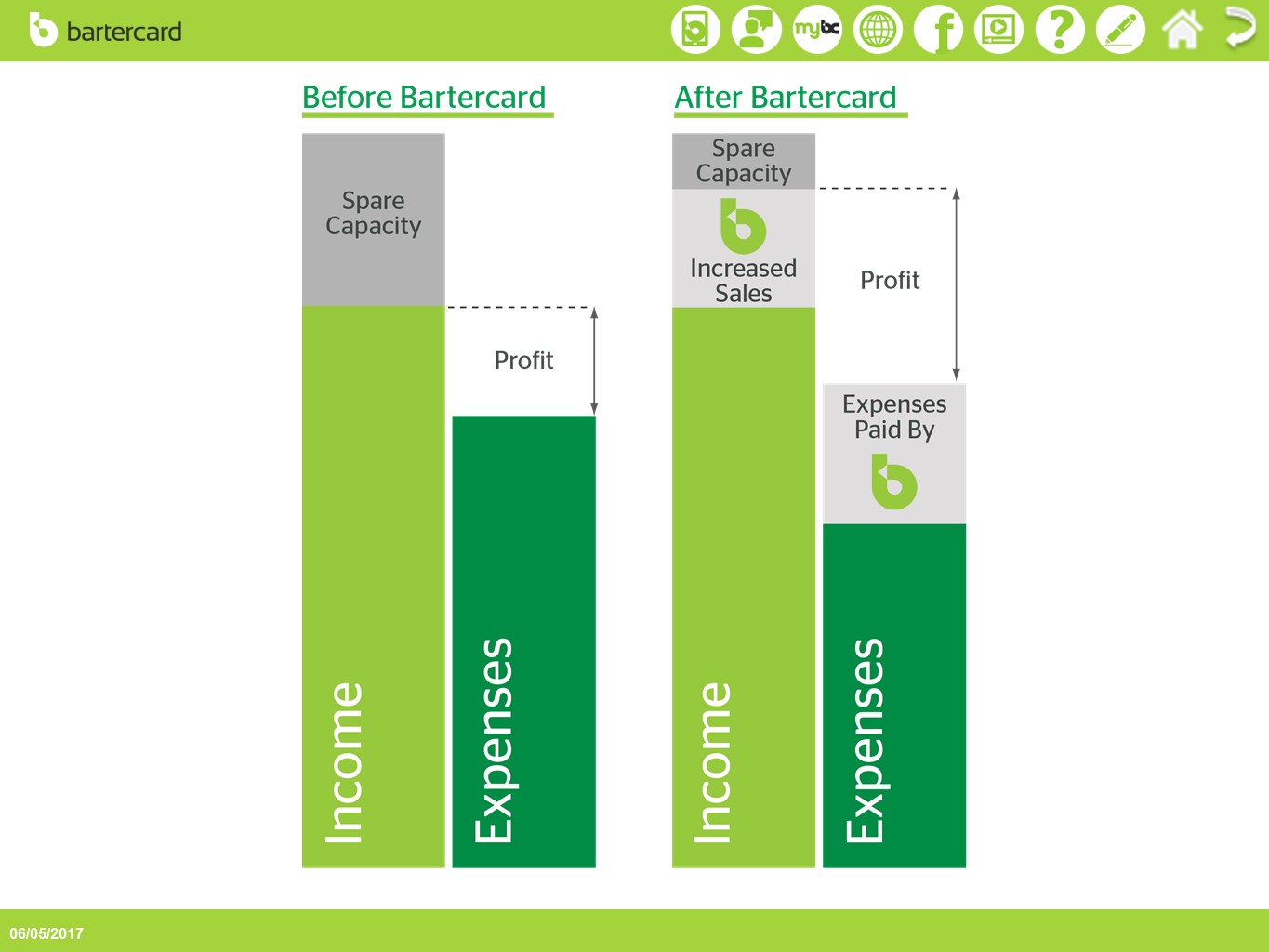

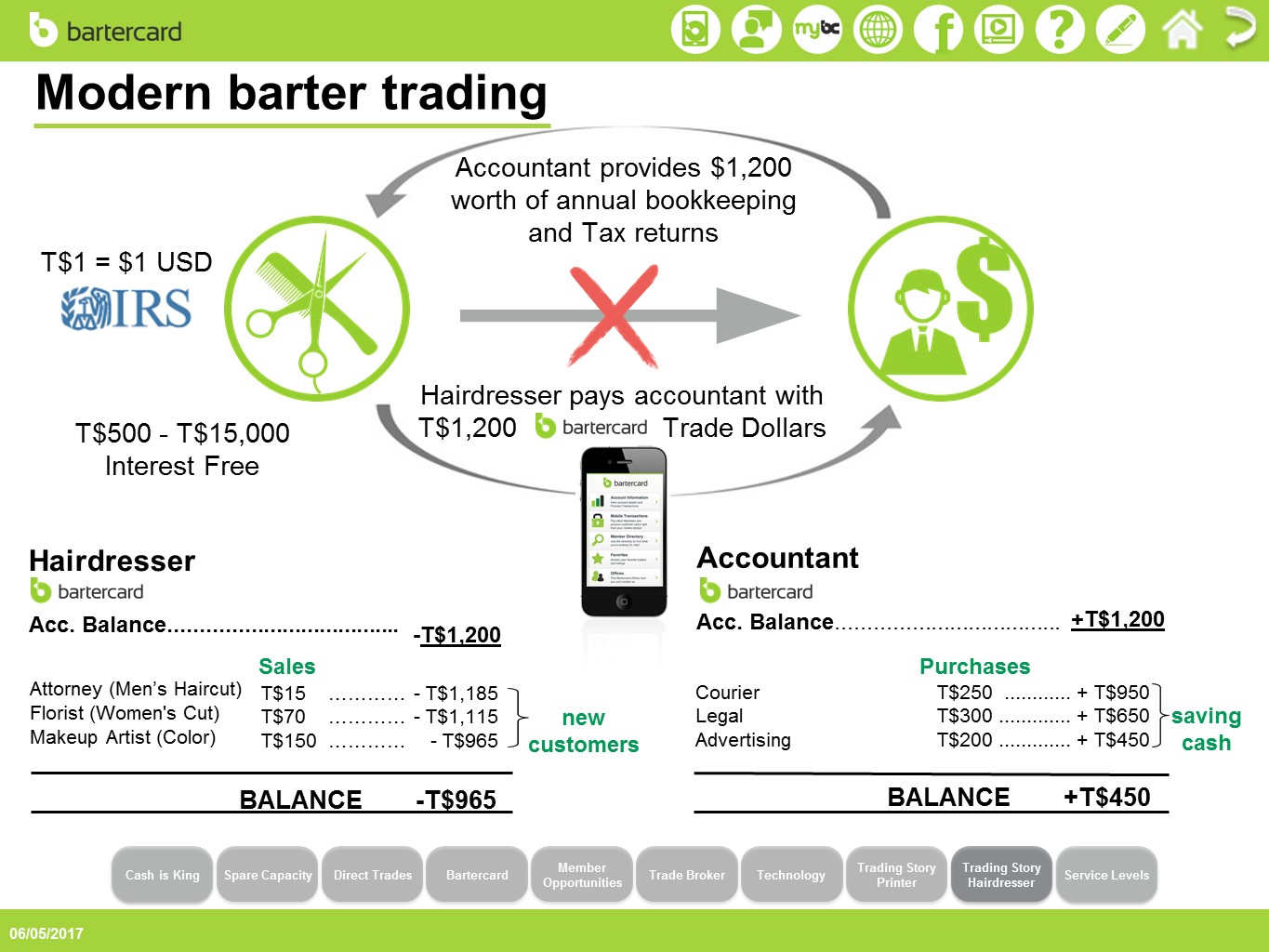

Lindsay Giardina- 8/3/17 on Bartercard

/Take a look at Lindsay's presentation on Bartercard and how it can help grow your business!

Eric T. Vallone, Esq. - 5/25/17 on Property Tax

/What is property tax? A tax based on the value of real property. New York does not have personal property taxes.

Who assess property taxes? Counties, cities, villages, towns, school districts, special tax districts, etc.

What do these governmental entities use property taxes for? Schools, police fire, roads, garbage, water, sewer, and other municipal services.

How is property tax determined? Two factors:

1. Taxable assessment

2. Tax Rate

All real property in a assessing unit (town, city, school district, etc.) is assessed (or given a value). However, not all real property is taxable. Churches, governmental buildings or land, and some businesses do no pay property taxes (tax breaks to convince a company to move into an area). Many homeowners have partial exemptions on their property taxes, such as veterans and owner-occupiers that qualify for the School Tax Relief (STAR) program.

How is the assessment determined? The assessment is based on the fair market value of the property, or what it would sell for between a willing buyer and a willing seller. Other methods of value include using the depreciated cost of materials and labor required to replace the property. Commercial property is sometimes valued based on its income producing potential. Some properties are not being used for their optimal value. These properties are usually assessed at their current use value. I.E. using commercial space as a warehouse versus a shopping plaza or office park. The assessment is completed by the tax assessor, which is an appointed or elected position of the governmental entity that is doing the taxing.

Once the assessment is done for every piece of property in a governmental unit, it's given an equalization rate, which is the rate used to tax the property. That is the same for every property, and is between 1 percent and 100 percent. You multiply the fair market value by the equalization rate then subtract any applicable exemptions to determine the taxable assessed value of that property.

How does the assessed value relate to the amount of taxes a property owner pays? The assessed value is multiplied by the tax rate to come up with the tax bill for a piece of property.

How is the tax rate established? The tax rate is set based on the tax levy required by the governmental entity.

How is the tax levy determined? The governmental entity develops and adopts a budget. Revenue from all other sources (fees, etc.) is calculated or estimated and subtracted from the budget. The remainder is the tax levy, or the amount of revenue that the government will raise from property taxes.

Ok, I know my assessment and the tax rate, now what do I owe? Let's say town Synergy has $40,000,000.00 in taxable assessed value, and a $2,000,000.00 tax levy. Gunning owns a house that's worth $100,000.00. Synergy taxes at 15 percent of value, so Gunning's house has a $15,000.00 assessment. The tax rate is determined by dividing the tax levy by the taxable assessed value, so Synergy's tax rate is 0.050 percent, or $50.00 for every $1,000.00 of assessed value. That means Gunning pays $750.00 for property taxes.

Let's say that Synergy instead taxes at 100 percent of value. What changes? The taxable assessed value would now be $266,666,666.67. The assessment remains the same at $2,000,000.00. We work the formula and the rate changes to 0.0075 percent. We multiply that by $100,000.00 and get $750.00.

What if my property is assessed for more than its worth? Each year, the assessor files the tentative tax roll. Usually, this happens on May 1st, but you can check with the assessor for the actual date. Any questions about the assessment can be discussed informally with the assessor before that year's tentative tax roll comes out. The assessor will discuss the assessment and the rationale behind it with you. Your tax bill will have the full value of your property, the assessed value, and the equalization rate.

Remember that the assessment is just one piece of the puzzle. If it's correct, there's not much you can do to change your tax bill. If it's too high, you can as for a formal review.

There are two levels:

1. Administrative review -- a grievance process conducted at the municipal level

2. Judicial review -- A. Small Claims Assessment Review B. Tax certiorari proceedings in State Supreme Court

Usually, grievance day is the 4th Tuesday in May. You will need evidence to prove what the market value of your property is, I.E. appraisal, recent sale, etc. Sales comparison -- comps.

Sometimes, your property will be assessed at fair market value, but your neighbors will be under assessed. This should be discussed with the assessor.

Prestige Administrative Consulting: 3/30/17

/Lindsay gave a great presentation on how Prestige can help alleviate the many burdens of your business. Click Here to learn more.

Dr. Brad Hopkins - 2/2/2017

/What Is Straight Up Health Performance?

Straight Up Health Performance is the premier provider of on-site wellness services, providing massage, chiropractic care, personal training and nutritional support to businesses throughout the Western New York region.

Employees will leave each treatment feeling invigorated and relaxed, able to return to work renewed and ready to go.

In addition, by providing our services to your employees, your company is boosting morale as well as productivity, putting your company on the forefront of workplace wellness and employee engagement

For More Information, Contact Straight Up Health Performance at:

info@straightuphp.com

Speaker - Dawn Kane 10/13/16

/Dawn Kane from Social Butterfly Marketing gave a fantastic presentation on reputation management on October 13th. CLICK HERE to learn more.

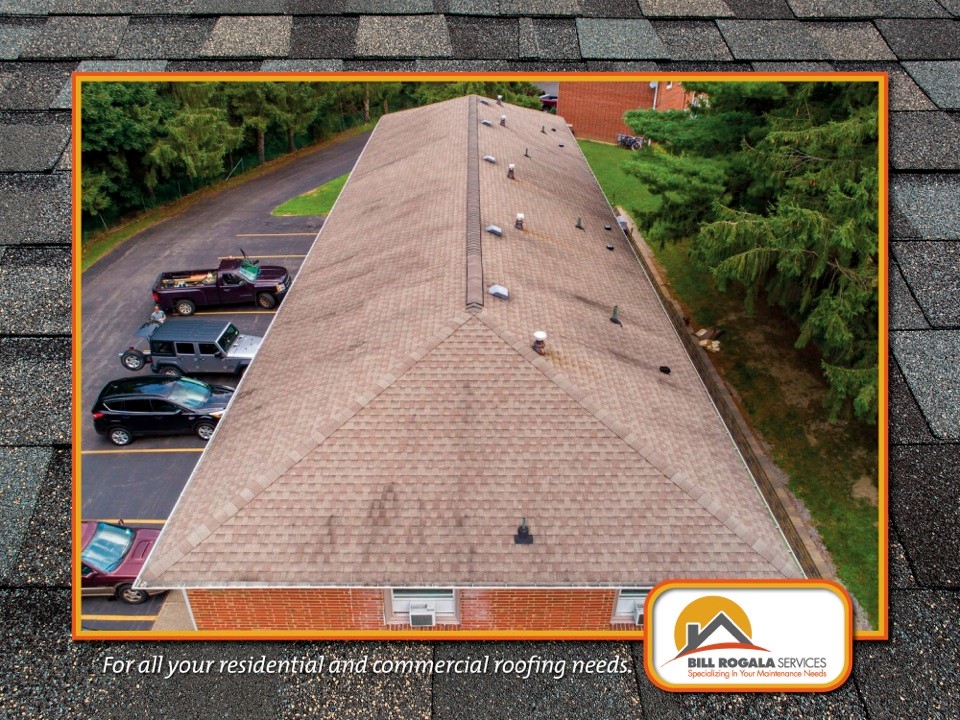

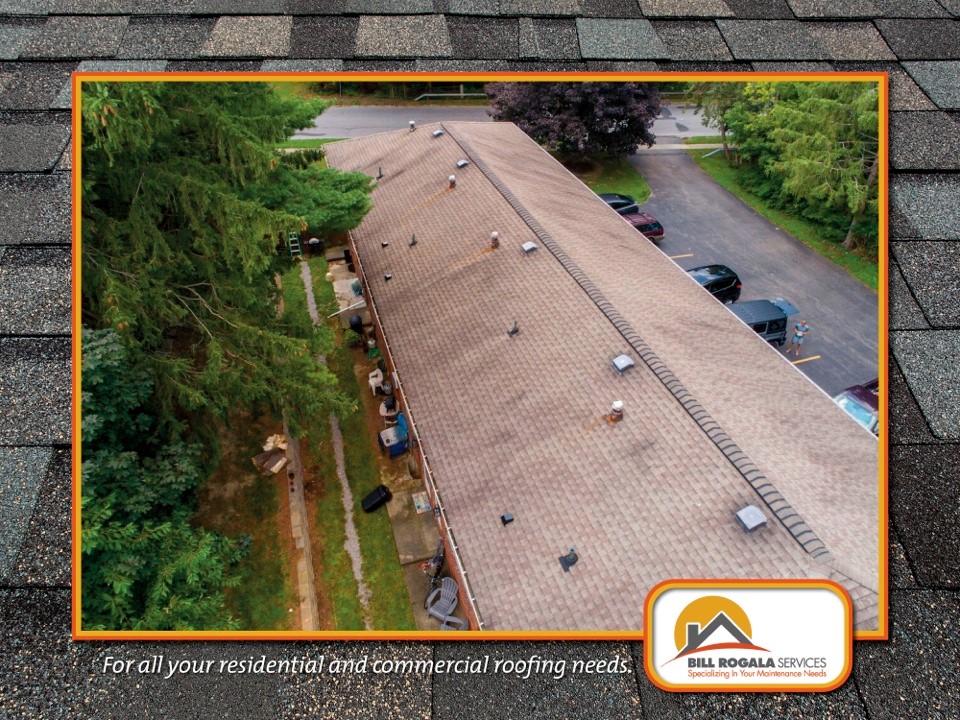

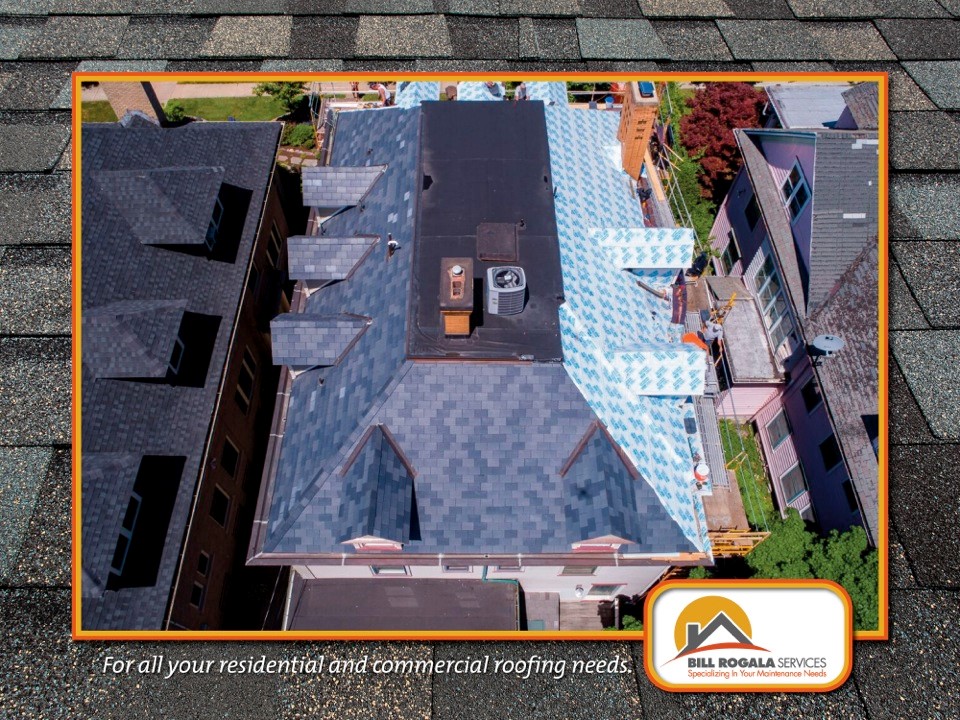

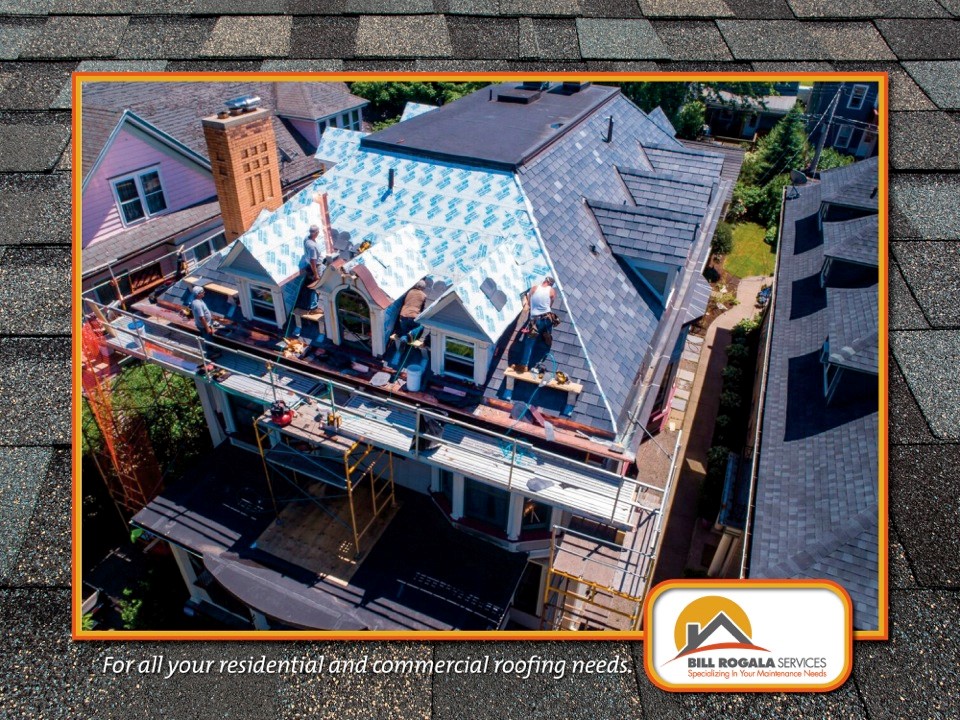

Speaker - Bill Rogala 7/21/16

/Bill Rogala did a great job explaining his business on July 21st. CLICK HERE to take a look at his presentation.

Speaker - Dr. Brad Hopkins 6/23/16

/Dr. Brad grew up in the town of Orchard Park and has lived in the western New York area for the past fifteen years. He is a graduate of Orchard Park High School and also received his Eagle Scout award as a member of Troop 230 at Nativity of our Lord church.

Dr. Brad is a graduate from the New York Chiropractic College (NYCC). Prior to attending NYCC he attended the University at Buffalo where he received his Bachelor’s Degree in Professional Studies. Dr. Hopkins has also received his Masters of Science in Applied Clinical Nutrition from the New York Chiropractic College’s School of Nutrition and holds his Certification in Kinesio Taping.

In addition, Dr. Brad is a Clinical Educator at the New York Chiropractic College located in Depew, NY. He is also a professor at the New York Institute of Massage located in Williamsville, NY. The courses he teaches include Neurology, Myology, Pathology and Nutrition.

In his free time, Dr. Brad enjoys spending time with his beautiful wife Brooke. He is also an avid Hockey and Football fan.

Speaker - Mark Brice 4/14/16

/Absolutely spectacular setting surrounds this spacious custom ranch home set on 8 acres. Incredible views of nature and serene lakes from every room. One of the most beautiful settings in Western New York. For more info. on this property, contact James Hoffman at 716-531-2898. Interested in adding some aerials into your next project?

Speaker - Alison Pierce 3/17/16

/Toshiba Business Solutions has been in the Buffalo area for about 10 years. We have the backing of our large parent company, Toshiba America Business Solutions, but all of our decisions are made at a local level right here in Tonawanda. In addition to multi-function printing, copying, scanning, and faxing devices, we also focus on helping local businesses streamline their paperwork process. Our solutions are each customer tailored to our client’s needs, so no two deployments are the same. We take the time to listen to our clients and work together to ensure we are doing what is best for them. We also have thermal label printers, digital signage, wide format printers, and high speed scanners. We are scheduled to launch our new product line later this spring and have some great deals on the remainder of our current equipment.

Speaker - Lori Carden 3/3/16

/I gave an overview of my Shop.com powered by Market America business. I purchased a shop.com franchise in 2008 and am now able to stay home with my daughter and enjoy retirement with my husband. This company has been in business for 24 years with an A+ rating with the better business bureau. Shop.com is a huge multi billion dollar product brokerage company. I spoke about one division of the brokerage and how to use www.shoploricarden.com to invest in a Shopping Annuity. I teach people how to turn the money they are already spending into a Shopping Annuity which will pay them residual income.

I would be happy to meet with you to analyze your spending and teach you how to invest your spent money into earning.

Speaker - Jason Berghold 2/4/16

/For the presentation, I talked about the various business programs that KeyBank offers its business clients. These are products that you wouldn’t normally think of when you think of business products. They include Health Savings Accounts, Key@Work program, KeyBank merchant services, and our Key4women program.

Health Savings accounts are designed for individuals who have a high deductible health plan. Employees can use a health savings account ( H.S.A.) to complement their current high deductible health plan (HDHP). This includes using your H.S.A. to pay for co-pays and other qualified medical expenses that would normally have to be paid out of pocket. Even better, is the money in the H.S.A. carries over each year, so any unused balance will not be forfeited.

Key@Work is a program that gives employees benefits and discounts on various products and rates just for participating in the program. Key@work is free to employers and is designed to reward employees for their hard work and service.

Key Merchant Services (KMS) offer businesses a chance to accept credit and other forms of digital and electronic payments in order to expand their business and profits. In a world where more and more people don’t carry any cash on them, Key merchant services allows business to accept other digital and electronic forms of payment so they don’t lose out on any sales. The funds are made available next business day. KMS also helps train employers and employees on new technology and our merchant processing systems. Key also offers a 24/7 service line to help with any questions or trouble shooting.

Key4Women is a program that offers opportunities to women business owners in the community. Women can come together to talk about their stories and offer advice to other women business owners. There are publications, forums, and networking events for women to come together and help each other in their respective markets. Key4women also offers discounts on Fedex shipping and has its own customer support line.

Speaker - Tom Suffoletto 12/10/15

/Tom Suffoletto of Pace Landscaping gave a fantastic presentation about Pace Backyard Ice Rinks. Here is a video for more information:

Want a backyard ice rink but don't have the time? Look no further! Pace Rinks is WNY's premier Outdoor Ice Rink Builder. Pace Rinks can provide the entire package, from setup, service, removal and storage. Just imagine a backyard outdoor ice rink in Buffalo in the cold winter months.

Speaker - Bill Solak 11/12/15

/I told a story about my life highlighting significant experiences and events that helped to define me as a person and professional. My goal was to give insight into who I am and the experiences that gave me the background to be successful in my profession as it has changed over the years.

Throughout my career I have been able to communicate effectively and motivate employees and co-workers to achieve success. My most recent challenge has been the transition to Sales, however my previous experiences in manufacturing management and communications has fueled my success. I have built my sales business at Emerling Chevrolet and now Cappellino Chevrolet from nothing to a Top Sales Professional in a seven year period by networking with other professionals.

I care about my customers and build my relationships through trust and performance. Business is all about relationships and trust. I am successful because I have built strong relationships.

Speaker - Steve Wischmann 10/29/15

/Horizon Performance Solutions (HPS) is a leadership and professional development consulting company. They provide leadership and professional development consulting and training for corporate teams, small businesses, government agencies, non-profit organizations, and individuals. Their tailored workshops and training packages address a wide range of topics including: leadership, supervisory skills, effective communication, emotional intelligence, critical thinking, and time management, among others. HPS will help you optimize your performance and foster a culture of success.

Steve Wischmann, the President and CEO of HPS, is a retired Coast Guard Captain with over thirty years of leadership experience and proven success in developing and leading teams and organizations of all sizes. Steve believes that, “Through leadership development and attention to organizational design and alignment every team, business, or agency can increase its capacity.”

Speaker - Jim Bitten 10/1/15

/Who We Are

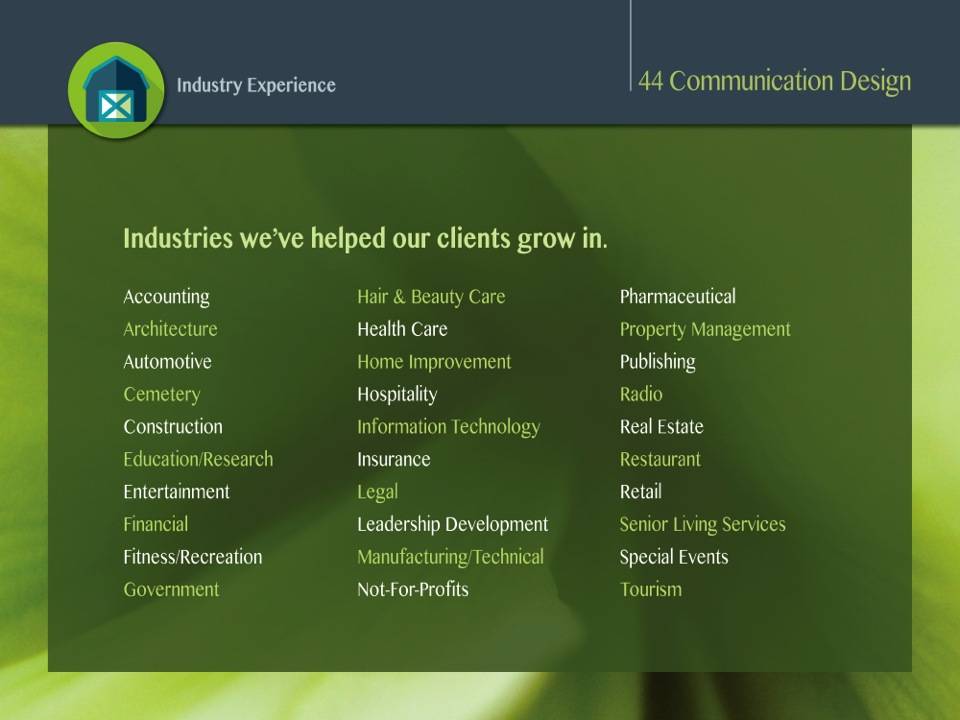

44 Communication Design is an advertising, design and marketing communications business with over 30-years experience servicing both small and large clients. We offer a hands-on personal approach that provides a high level of client service, creativity and affordability, while working together with your marketing effort to produce a creative solution that is imaginative and effective in meeting your business objectives.

What We Can Do For You

44 Communication Design can help you create a new image, build awareness for your business and develop advertising and marketing materials that transmits a clear, persuasive message to your customers.

Services provided:

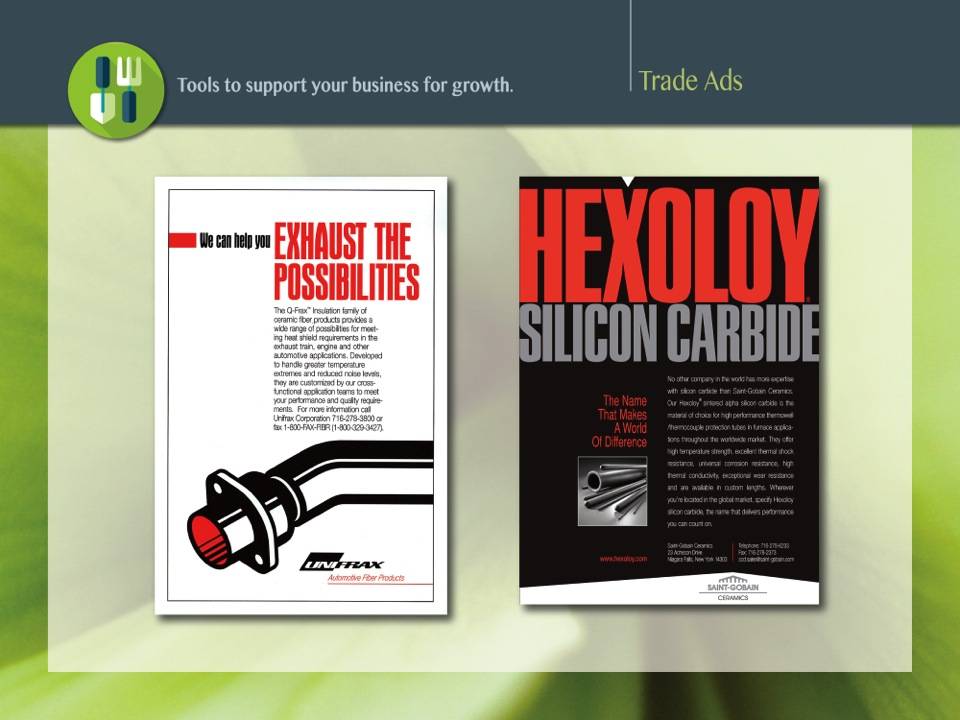

Print advertising

Digital advertising

Brochures

Direct mail

Pocket folders

Newsletters

Trade show graphics

Logo design

Branding

Posters

Menus

PowerPoint presentations

Signage

Packaging design

Publication design

Photography

Photo retouching

Technical copywriting

Promotional products

Media planning

Media placement

Want To Talk?

To find out more how 44 Communication Design can help to build awareness for your business by creating a strong professional image through advertising and

marketing communications, call 716-440-4849, or visit our website at www.44communicationdesign.com.